How to use Margin Trading on Gate.io

By

gate.io

1574

0

- Language

-

العربيّة

-

简体中文

-

हिन्दी

-

Indonesia

-

Melayu

-

فارسی

-

اردو

-

বাংলা

-

ไทย

-

Tiếng Việt

-

Русский

-

한국어

-

日本語

-

Español

-

Português

-

Italiano

-

Français

-

Deutsch

-

Türkçe

-

Nederlands

-

Norsk bokmål

-

Svenska

-

Tamil

-

Polski

-

Filipino

-

Română

-

Slovenčina

-

Zulu

-

Slovenščina

-

latviešu valoda

-

Čeština

-

Kinyarwanda

-

Українська

-

Български

-

Dansk

-

Kiswahili

About Margin Trading

On Gate.io, investors can use their crypto assets as collateral to borrow great sums of capital. Investors must repay the loans within the time limit. Leveraged trading is similar to securities margin trading in the stock market. Investors use leverages to amplify profits while also amplifying risks.

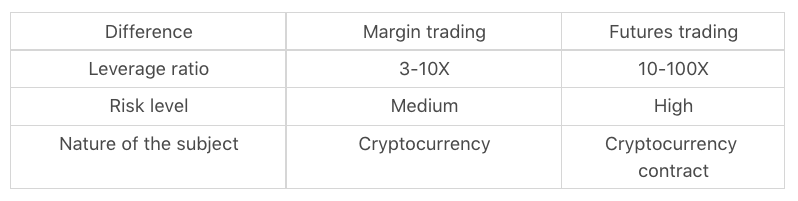

Margin trading vs. futures trading

How to conduct margin trading

Example:Lee thinks that the BTC market is looking very bullish in the coming month. In order to obtain higher profits, Lee plans to trade on margin. Lees account has 10,000 USDT and he wants to borrow 10,000 USDT in order to double the return.

First, he transfers 10,000USDT to his margin account as collateral. (Collateral: The funds investors deposit as an agreement to obey the trading rules. Only after the collateral has been transferred to the margin account can investors start borrowing funds.)

Then Lee chooses the loan period and interest rate and he borrows 10,000 USDT, whose repayment is due in 30 days with the daily interest rate being 0.02%. Lee bought 4 BTC at the price of 5000USDT each. 25 days later, the price of BTC rises to 10,000USDT. Lee sold all the BTC and repaid his margin loan in advance. Compared to trading with no leverage, he made an extra profit of 9,950USDT.

Comparing profit

Profit from margin trading: [10,000USDT (initial collateral)+10,000USDT(margin loan)]/5,000USDT(BTC buying price)*10,000USDT(BTC selling price)-10,000USDT(initial collateral)-10,000USDT*(1+0.02%*25)(margin loan interest)=19,950USDT

Profit from trading without leverage: 10,000USDT (margin)/5,000USDT(BTC buying price)*10,000USDT(BTC selling price)-10,000USDT(margin)=10,000USDT

We can tell from the calculation results that trading with leverage made Lee 9,950USDT more profit than without.

Say Lee thinks that the BTC market is looking bearish in the coming month. He transfers 10,000USDT into his margin account when the price for one BTC is 5,000USDT. He borrows 2 BTC and sells them to get 10,000 USDT. 25 days later, the price for one BTC rises to 9,100USDT. Now Lee needs to give out 18,200USDT for 2 BTC to pay off his loan, which means Lees balance reduces from 20,000USDT to 1,800USDT. Lee loses 8,200USDT. At this point, the risk rate of Lees account is lower than 110%. Forced liquidation is triggered to stop further loss.

*Risk rate = total balance/loan volume *100%

When Lee gets the loan: Risk rate = 20,000USDT(total balance)/[5,000USDT(BTC buying price)*2(number of BTC borrowed)]*100%=200%

25 days later: 1BTC=9100USDT

Risk rate = 20,000USDT(total balance)/[9100USDT(BTC selling price) *2(number of BTC borrowed)]*100%=109.9%

The lower the risk rate, the higher the risk. When the risk rate falls below 110%, forced liquidation will be triggered.

If the price of BTC goes down as Lee predicts, when the price reaches 2,500USDT, Lee buys 2 BTC to repay the loan. Now Lees net balance is 15,000USDT(interest and handling fees not calculated). The price of BTC halves but Lee makes a profit of 5,000USDT. The reward ratio is 50%, which means you can make huge profits from trading in a bearish market too. Lee comes to the following conclusion: By introducing leverage, spot trading can amplify returns when the market moves in the same direction as the investor predicts. The investor can profit by trading with leverage in a bearish market too. But if the market moves in the opposite direction as the investor predicts, the loss will also be amplified accordingly.

How can investors manage their finances?

The idle assets in the account can be used for margin borrowing to generate extra revenue. When lending through a Gate.io financial management product, lenders can decide the loan amount and interest rate.

Are the loaned assets safe?

The loaned assets will be used by users of Gate.io to conduct margin trading. Gate.io guards the safety of financial management funds through a comprehensive risk control mechanism.About Margin Loans

1.The maximum volume of a margin loan is determined by the leverage ratio. Currently, Gate.io supports leverage ratios from 3 to 10. Say the leverage ratio is 3 and you have 100BTC in your account as margin, the maximum volume of margin loan you can arrange is 200BTC.Maximum loan volume = (total account balance - borrowed assets - unpaid interest)*(leverage ratio - 1) - borrowed assets

2.Please pay off your loan before or on its repayment day (10 days after receiving the loan). If the loan is still not paid off after its repayment date, Gate.io will take over and host the positions. If necessary, liquidation will be triggered to ensure the repayment.

3.Interest starts to accumulate once the loan has been borrowed. For loans paid off within 4 hours after borrowing, the interest is calculated as 4 hours. After 4 hours, the interest is calculated on an hourly basis. Less than 1 hour will be seen as 1 hour.

Interest calculation formula:

Interest = loan volume * daily interest rate/24 *number of hours

4.When users conduct margin trading, Gate.io offers services which monitor your margin account and manage risks.

5.When the risk rate of your margin account is lower than the threshold, Gate.io will warn you with an email. The threshold of risk rate varies from pair to pair. At present, trades with leverage ratios from 3 to 5 will be warned of risk management when the risk rate goes below 130%. When the leverage ratio is 10, the threshold is 110%.

a: total balance of quote currency

b: outstanding interest of quote currency

c: last price

d: total balance of base currency

e: outstanding interest of base currency

f: loan volume of quote currency

g: loan volume of base currency

6.When the risk rate of your margin account is lower than a certain threshold, liquidation will be triggered and Gate.io will buy or sell your assets at the real-time order price to repay the loan. The risk rate threshold for trades with leverage ratios of 3 to 5 is 110%, for trades with a leverage ratio of 10 is 105%.

7.After forced liquidation is triggered, Gate.io will not repay the loan until it is due. You can still add more margin to keep trading. If the loan is not paid off until the repayment date, the positions will be liquidated to repay the loan.

8.Users should recognize that fees will be generated while trading on margin. Users should agree to pay the fees. The fee rate is the same as it is in spot trading.

9.When your margin trades are making profits, you can withdraw the profit out of the margin account. When there are unpaid margin loans, the maximum amount of assets you can withdraw is:

Maximum withdrawal volume = total balance of the margin account (frozen balance included) - loan volume * leverage ratio/(leverage ratio -1)

10.When you trade on margin, please be aware of the risks of crypto investments and margin trading. Please tread carefully.

11.Borrowers can repay loans in advance but the actual financial management cycle is subject to the agreed repayment date.

12.Users should agree that all investments made on Gate.io represent their true intentions and accept all potential risks and profits brought about by investment decisions.

13.Gate.io does not take responsibility for the potential delays of emails on any third-party software. Please check your account frequently.

14.The right of final interpretation of this document is reserved by Gate.io.

Contact us by submitting a ticket whenever you have questions.

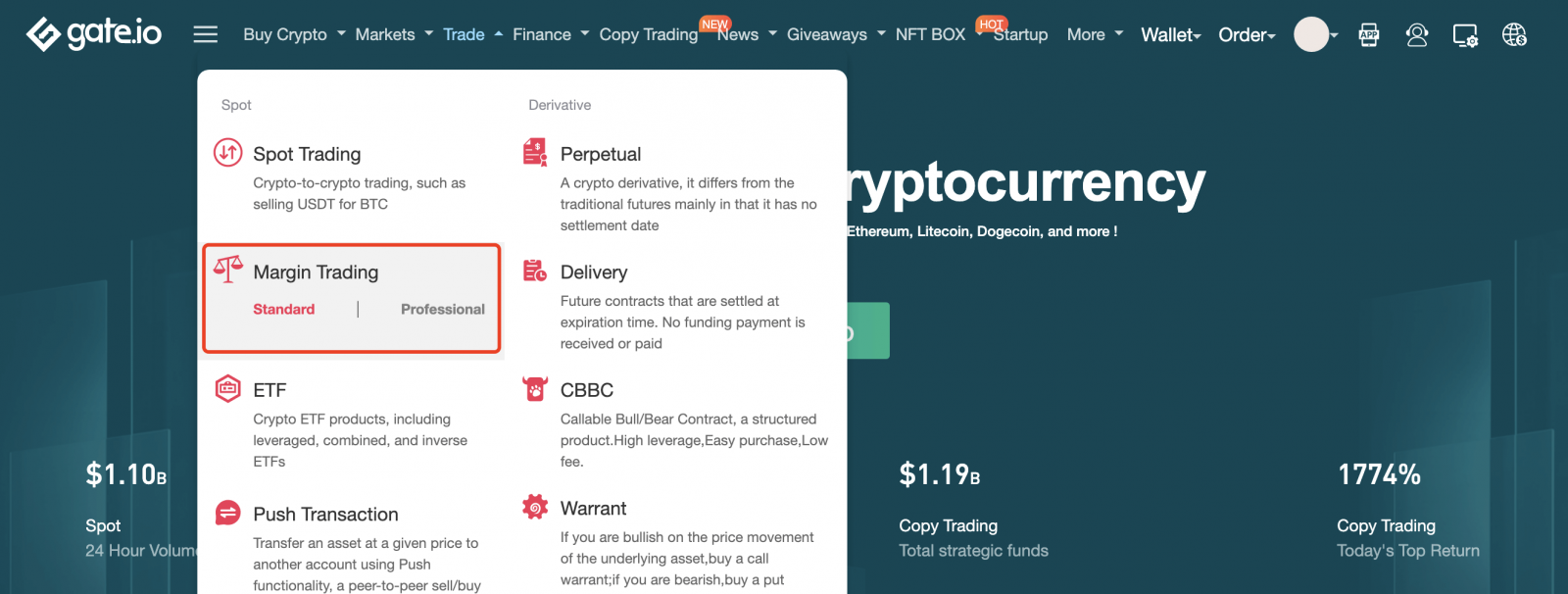

How to Conduct Margin Trading on Web【PC】

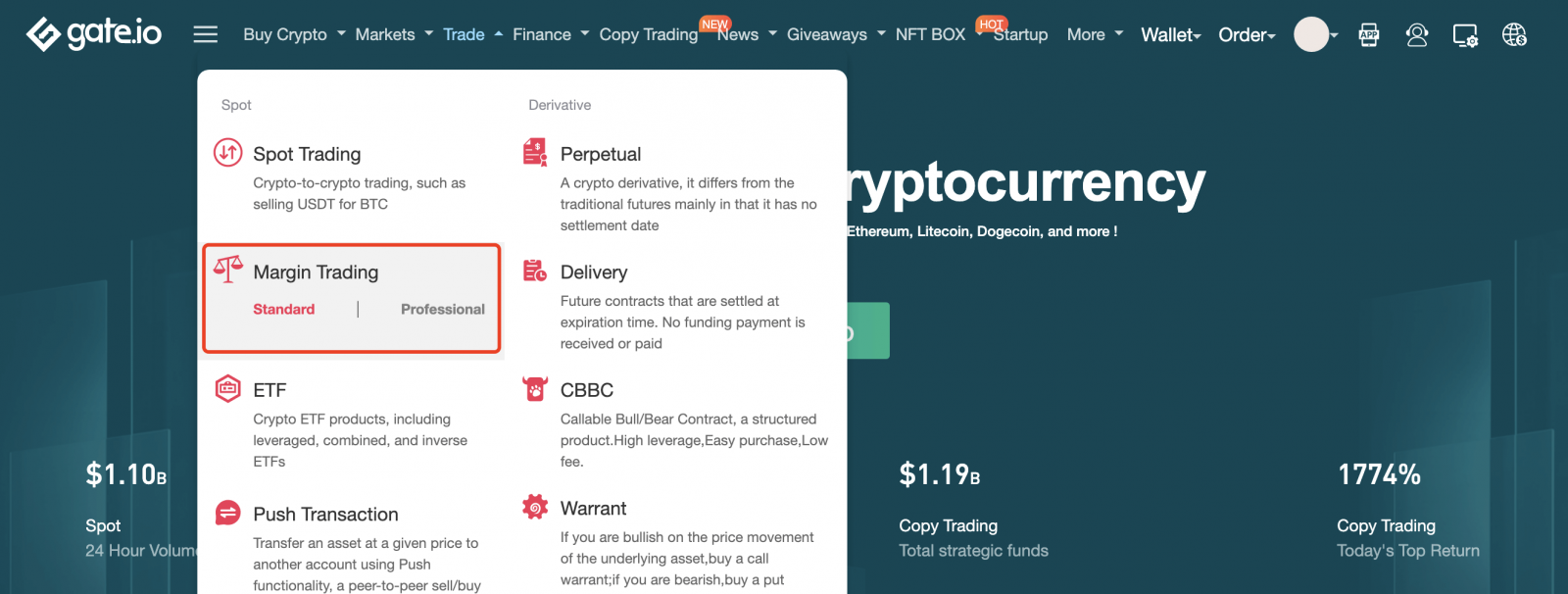

Step 1: Log in to your account. Click on "Margin Trading" under "Trade" on the top navigation bar. You can either choose "standard" or "professional" version. This tutorial uses standard version.

Step 2: Search and enter the pair you want to trade. (GT_USDT as an example here)

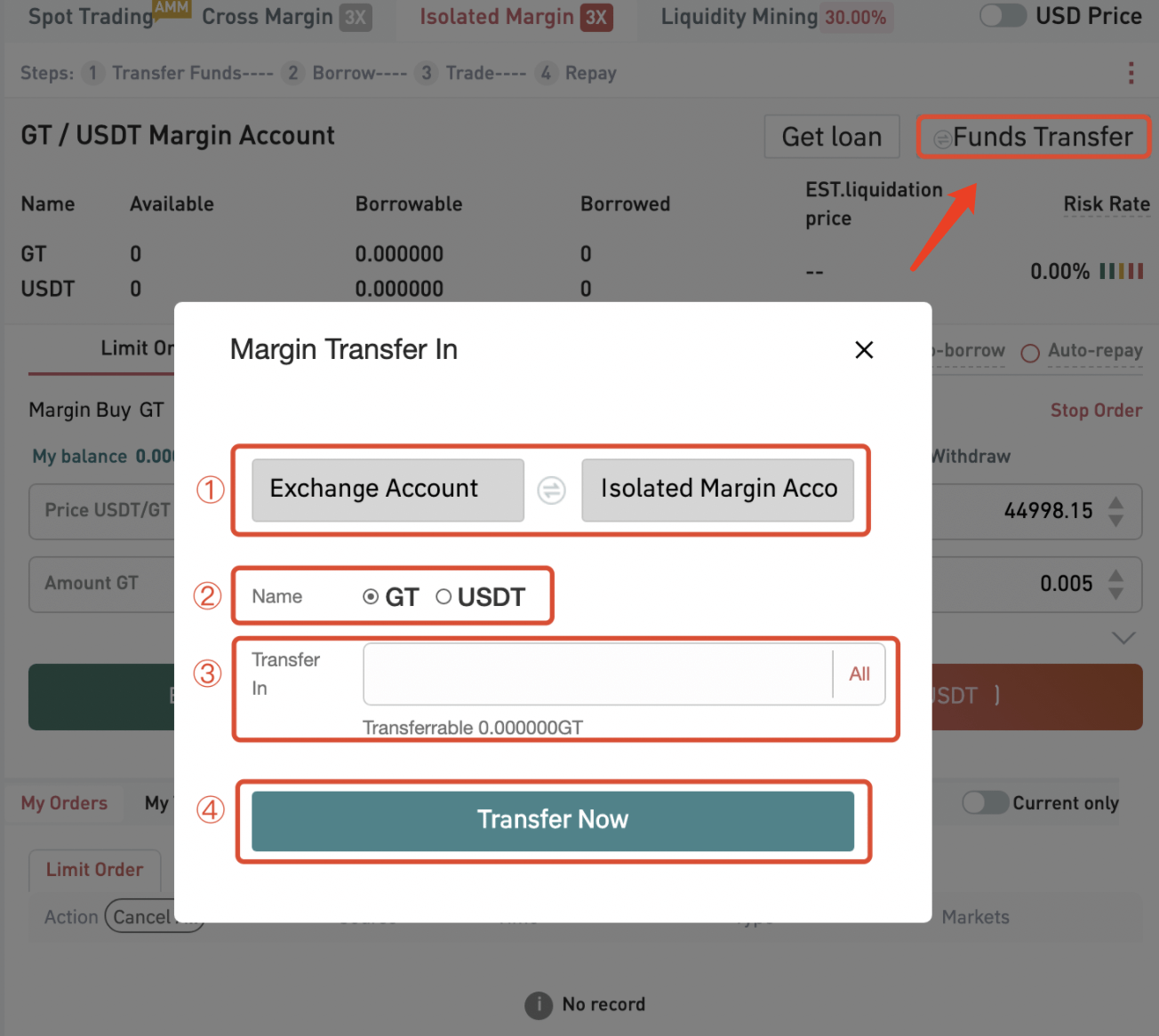

Step 3: Click on "Funds transfer" and proceed as follows

① Determine the transfer direction

② Select the coin to be transferred

③ Enter the volume of the transaction

④ Click on "Transfer Now"

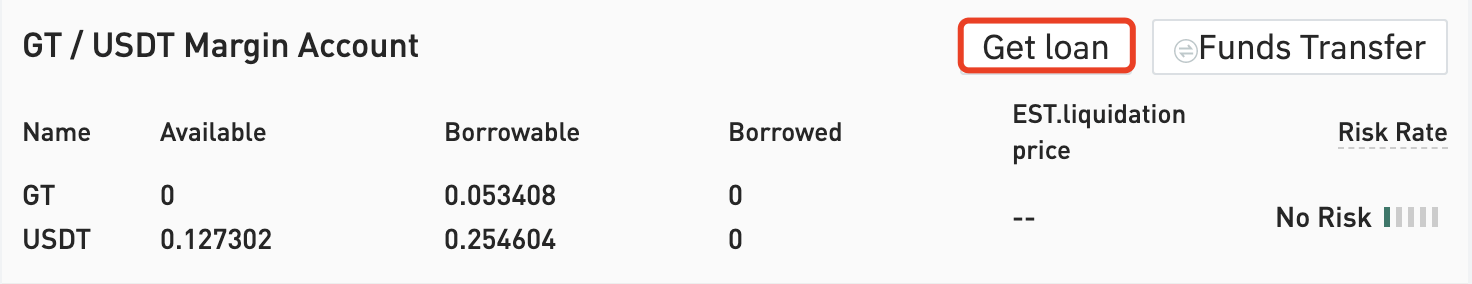

Step 4: Click on "Get loan" to borrow GT or USDT. Here you can view the loans of your account.

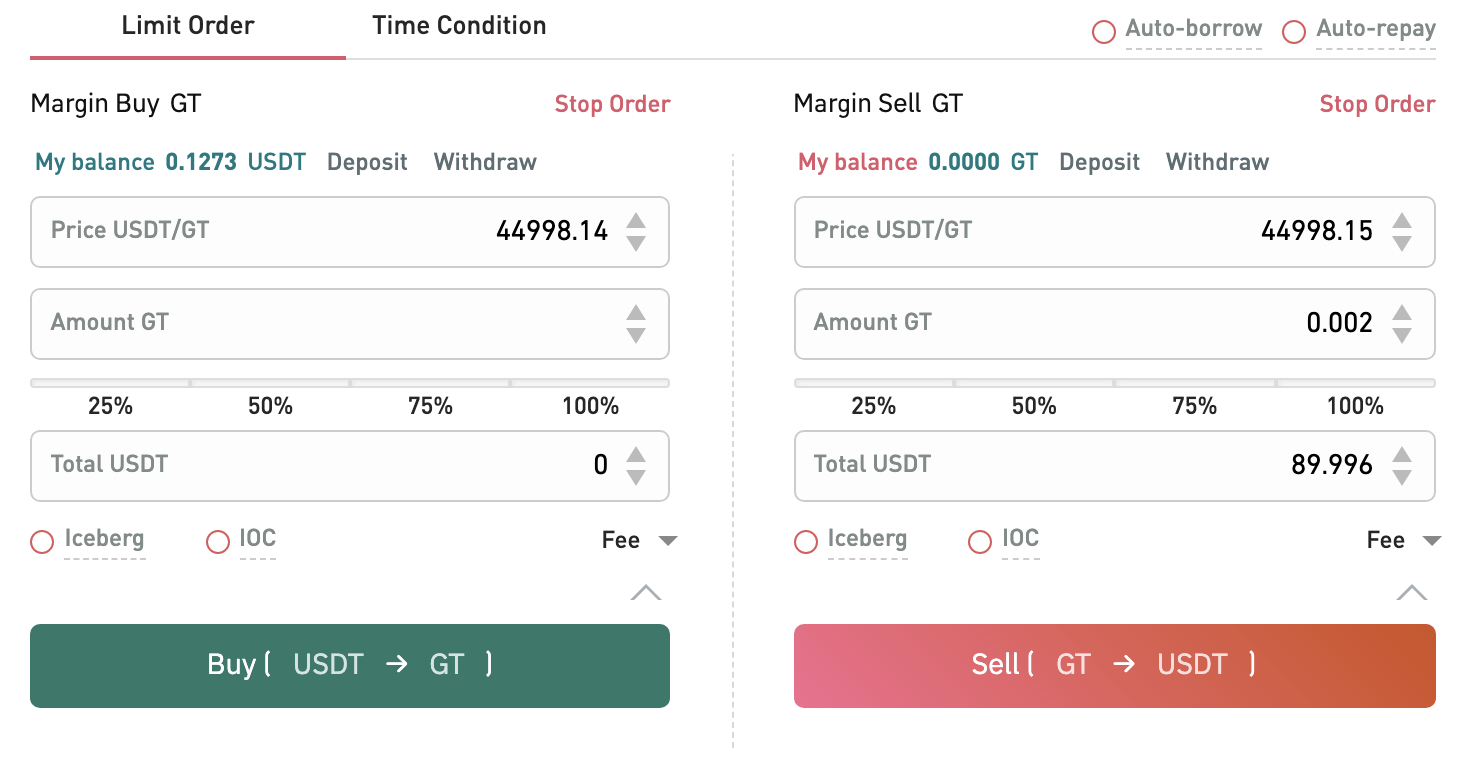

Step 5: Choose from "buy" and "sell" according to which currency you have borrowed. Set buying/selling prices and buying/selling amount (or exchange total). You can also click on the last prices on the order book to set the buying/selling price conveniently. Then click on "Buy"/"Sell".

(Note: The percentages under the "Amount" box refer to certain percentages of the account balance.)

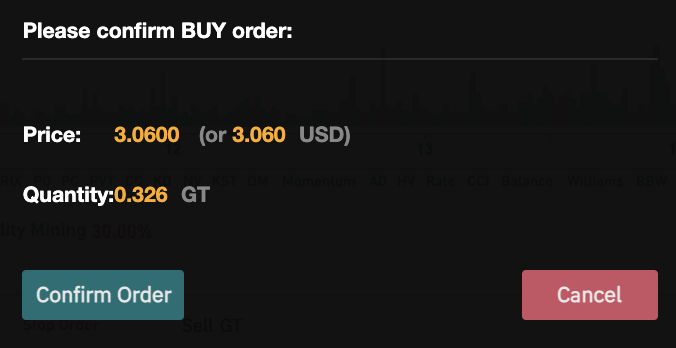

Step 6: Confirm the price and amount. Then click on "Confirm Order".

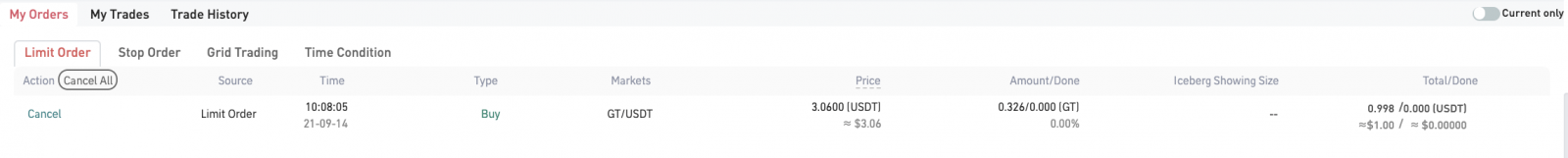

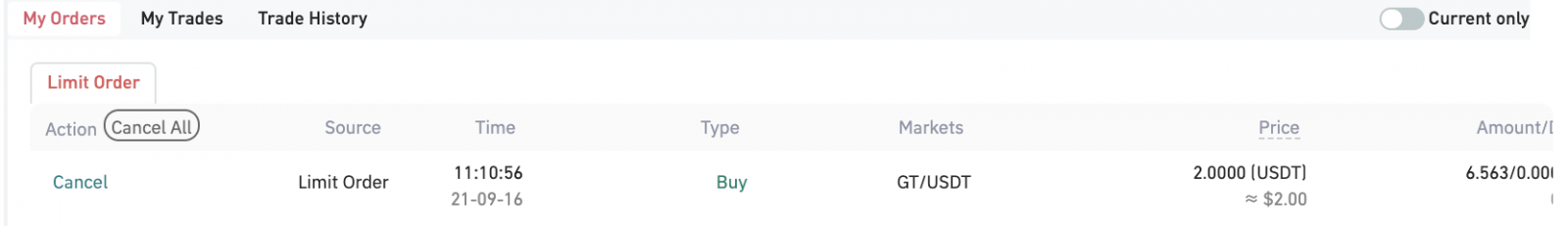

Step 7: After successfully placing an order, you will be able to view it in "My Orders" at the bottom of the page. You can also cancel the order here by clicking on "Cancel".

Note:

1.When the price rises, go long to make profits.

2.When the price falls, go short to make profits.

3.By introducing leverage, if the market trend goes as expected, the gains will be amplified, but if the market trend goes the opposite of the expectation, the losses will be also be amplified. Please stay vigilant and manage risks when necessary.

How to Conduct Margin Trading on mobile phone【APP】

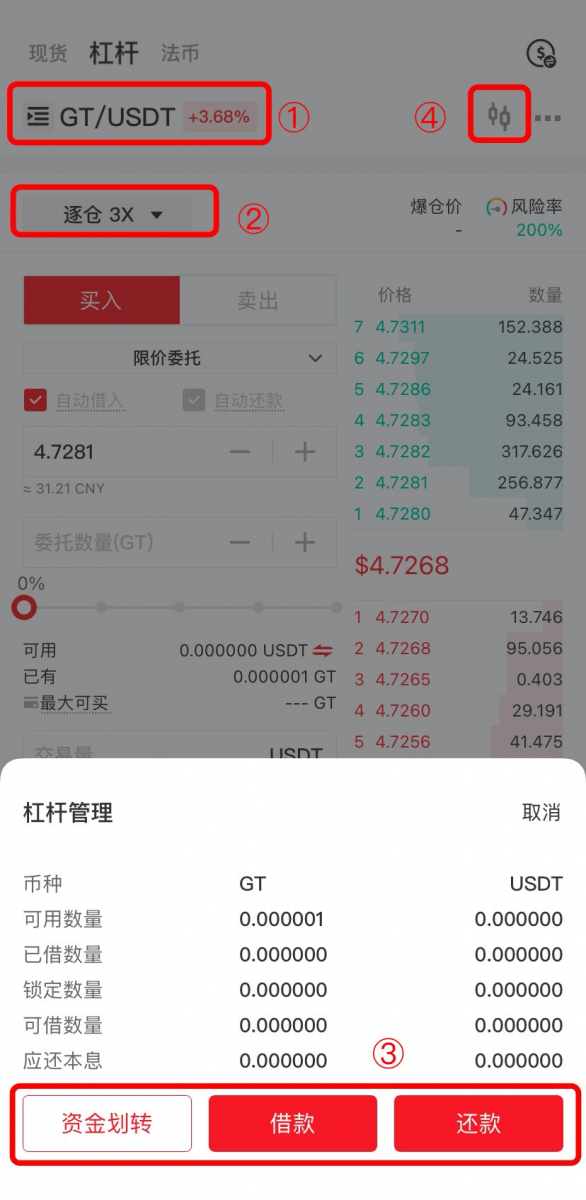

Step 1: Open Gate.io mobile app and log in to your account. Click on "Exchange" on the bottom navigation bar, then "Leverage".① Select the pair you want to trade.

② Here shows the leverage ratio of the current trade. Click to manage your margin account.

③ Click to transfer funds, borrow or repay loans.

④ Entrance to the candlestick chart of the chosen pair.

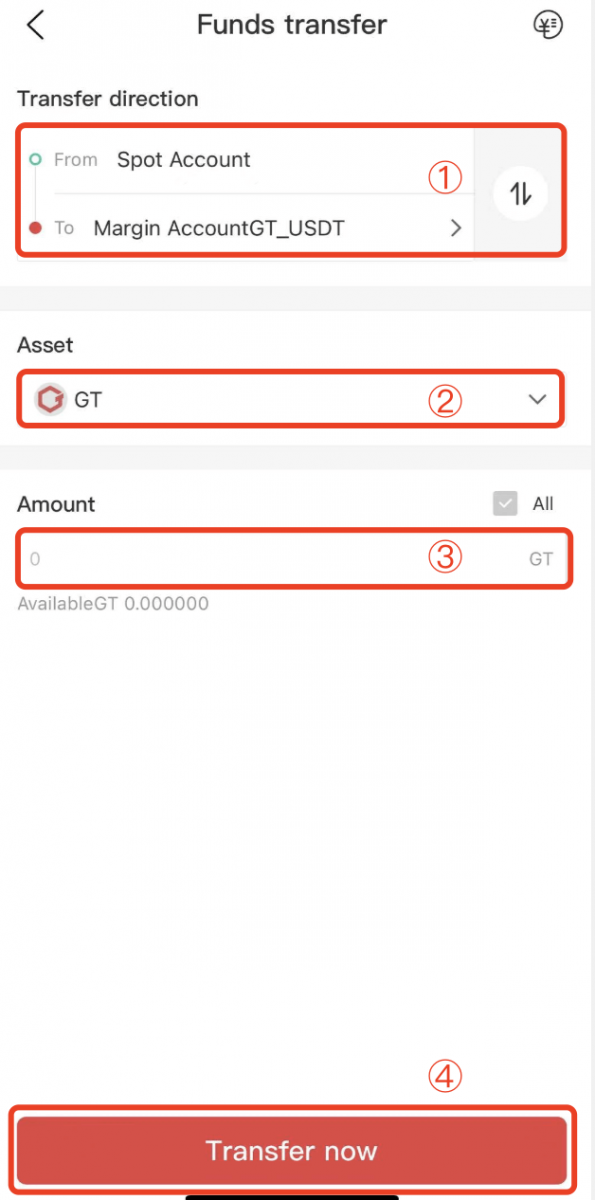

Step 2: Before conducting margin trades, users need to transfer collaterals first:

① Determine the transfer direction.

② Select the coin to be transferred.

③ Enter the volume of the transaction.

④ Click on "Transfer now".

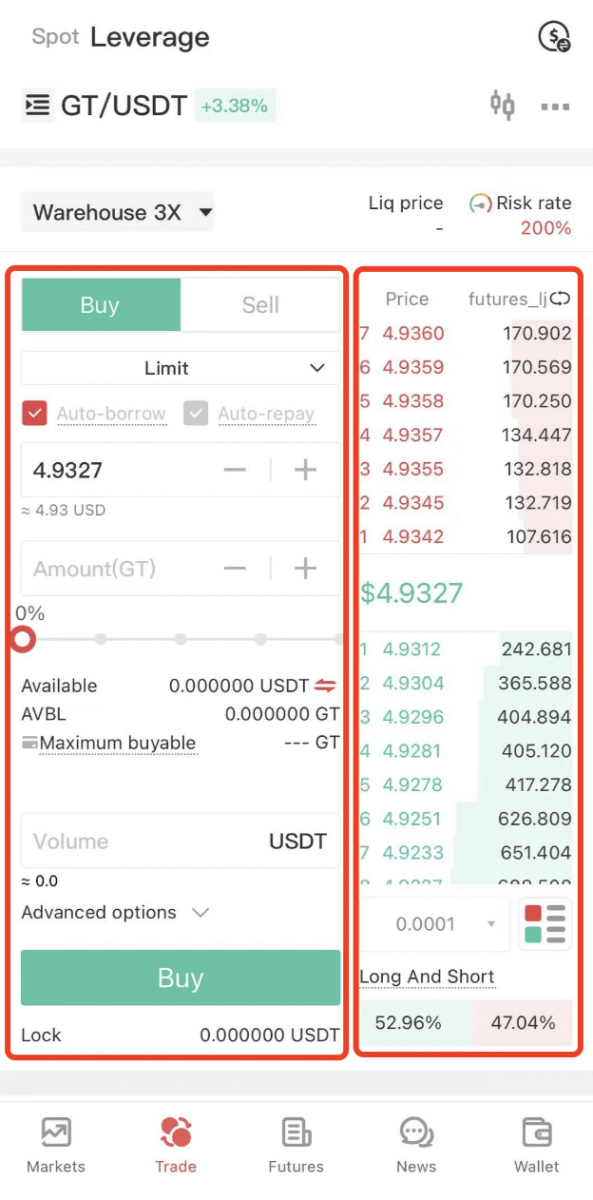

Step 3: Choose from "buy" and "sell" according to which currency you have borrowed. Set buying/selling prices and buying/selling amount. You can also click on the last prices on the order book to set the buying/selling price conveniently. Then click on "Buy"/"Sell".

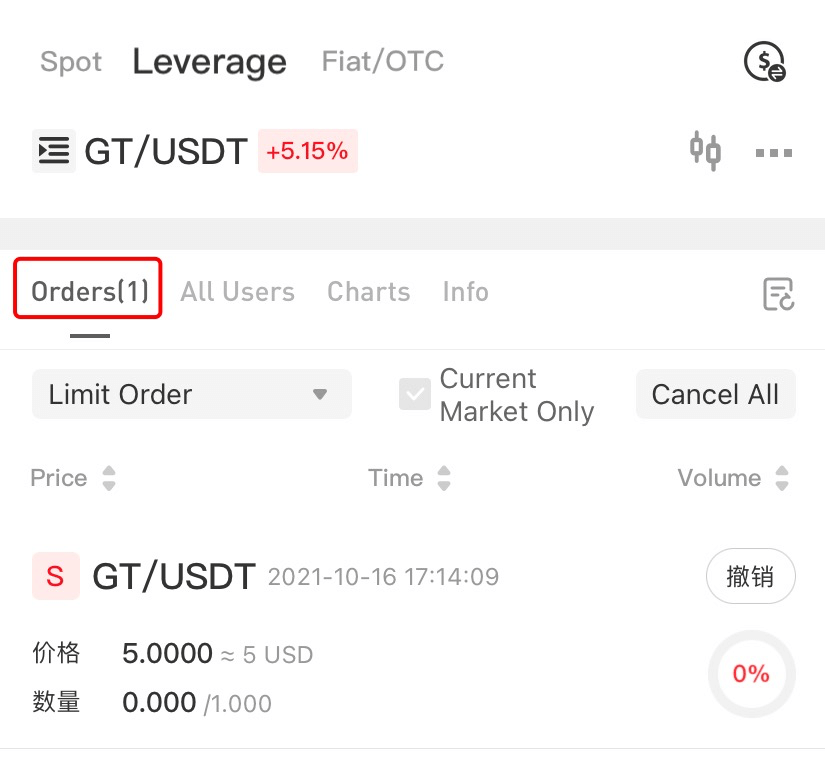

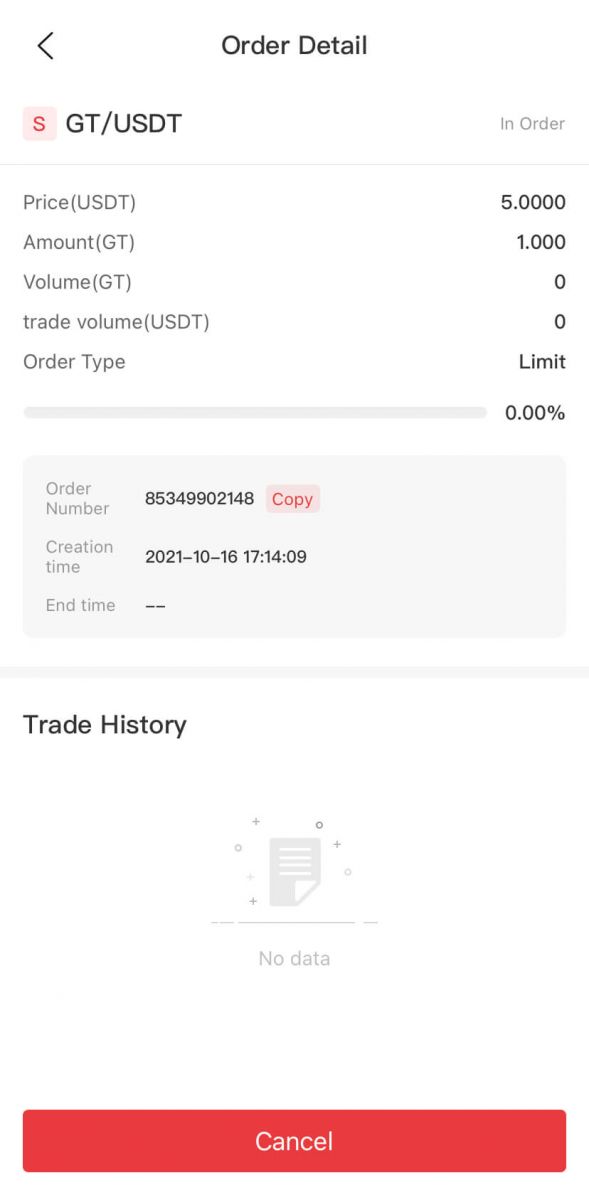

Step 4: After successfully placing an order, you will be able to view it in "Orders" at the bottom of the page.

Step 5: Click to view details of any order on the list. Before an order gets filled, the user can cancel it by clicking on "Cancel".

How to Conduct Cross Margin Trading

Step 1: Log in to your Gate.io account. Go to "Trade" - "Margin Trading". You can either choose "standard" or "professional" version. This tutorial uses standard version.

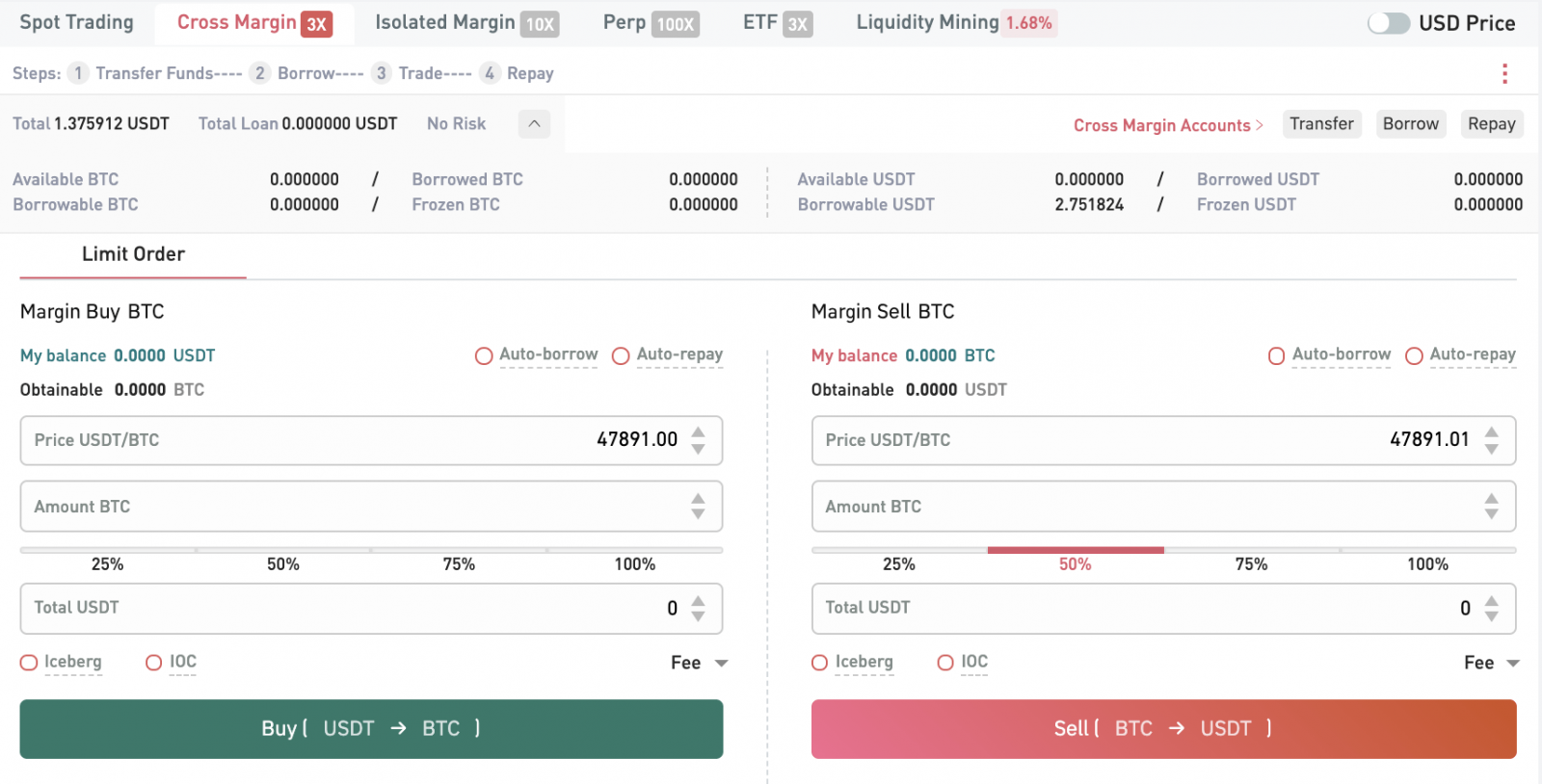

Step 2: Search and enter the pair you want to trade (GT/USDT as an example here). Click on "Cross Margin" below the candlestick chart.

Step 3: Click on "Funds transfer" and proceed as follows

① Determine the transfer direction

② Select the coin to be transferred

③ Enter the volume of the transaction

④ Click on "Transfer Now"

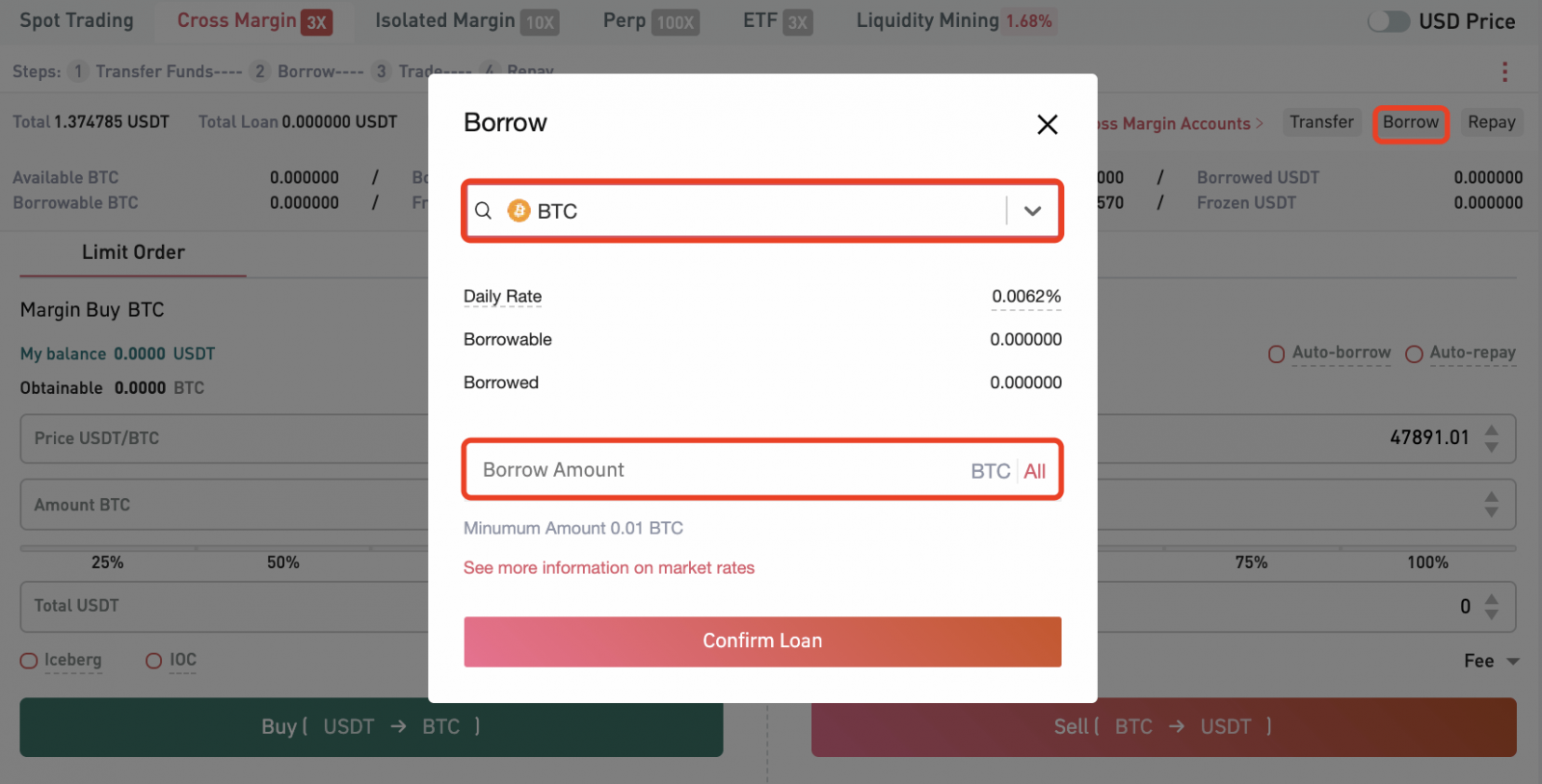

Step 4: Click on "Get loan" to borrow loans. Select the currency you want to borrow. Enter the amount. Then confirm borrowing the loan. Click on "see more information on market rates" to view more information on all borrowable currencies.

Step 5: Choose from "buy" and "sell" according to which currency you have borrowed. Set buying/selling prices and buying/selling amount (or exchange total). You can also click on the last prices on the order book to set the buying/selling price conveniently. Then click on "Buy"/"Sell".

(Note: The percentages under the "Amount" box refer to certain percentages of the account balance.)

Step 6: Confirm the price and amount. Then click on "Confirm Order" and enter your fund password.

Step 7: After successfully placing an order, you will be able to view it in "My Orders" at the bottom of the page. You can also cancel the order here by clicking on "Cancel".

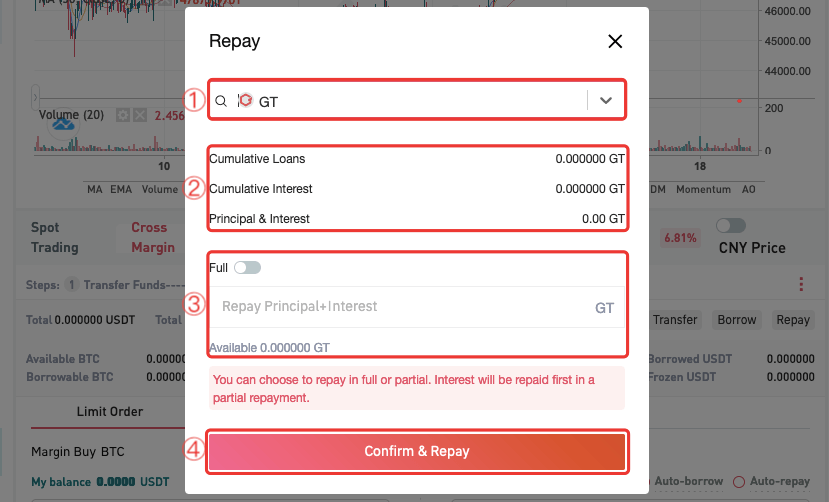

Step 8: If you want to repay the loan, click on "Repay" and proceed as follows:

① Select the currency you want to repay

② Check the cumulative loans, cumulative interest, principal and interest.

③ Decide if you want to repay the full loan. If you only intend to pay off a part of the loan, enter the amount you want to repay in the box.

④ Check if every box is filled in correctly and click on "Confirm Repay"

Margin Trading Terms

1.Base currency:is the token against which exchange rates are generally quoted. In BTC_USDT pair, BTC is the base currency.

2.Quote currency:

is used as reference to give us the relative value of the Base currency.In BTC_USDT pair, USDT is the quote currency.

3.Total assets:

the sum of assets in margin trading account, including locked assets and available assets.

4.Transfer in asset:

asset transferred into margin trading account from exchange account.

5.Borrowed asset:

asset borrowed with asset transferred into margin trading as a collateral.

6.Available asset:

asset that is available to place orders in margin trading account, including asset borrowed and transferred in.

7.Locked asset:

balance not available to place orders in margin trading.In general, it refers to asset in order.

8.Long:

take BTC_USDT as an example, if you believe BTC price will rise, you can borrow USDT to buy long.That is,buy BTC at current low price and sell BTC at a higher price later to amplify your gains.

9.Short:

Take BTC_USDT pair as an example, if you believe BTC price will go down, you may borrow BTC and sell short. That is, sell at current high price and buy at a lower price later to benefit from drops in BTC price.

10 Risk Rate:

The total-to-loan ratio in margin trading account. The indicator to uate risk of a forced liquidation. The higher the risk rate, the lower the loan ratio is, and less chance the margin trading account will be force liquidated.

11.Forced liquidation:

when the risk rate in margin trading account is low to liquidation threshold, forced liquidation is triggered.All of the position of this pair are closed automatically to prevent further loss and ensure you do not default on your loan.

12.Est.Liquidation price:

A calculated price when the risk rate equals to liquidation threshold. A forced liquidation will be triggered when the price reaches this value.

- Language

-

ქართული

-

Қазақша

-

Suomen kieli

-

עברית

-

Afrikaans

-

Հայերեն

-

آذربايجان

-

Lëtzebuergesch

-

Gaeilge

-

Maori

-

Беларуская

-

አማርኛ

-

Туркмен

-

Ўзбек

-

Soomaaliga

-

Malagasy

-

Монгол

-

Кыргызча

-

ភាសាខ្មែរ

-

ລາວ

-

Hrvatski

-

Lietuvių

-

සිංහල

-

Српски

-

Cebuano

-

Shqip

-

中文(台灣)

-

Magyar

-

Sesotho

-

eesti keel

-

Malti

-

Македонски

-

Català

-

забо́ни тоҷикӣ́

-

नेपाली

-

ဗမာစကာ

-

Shona

-

Nyanja (Chichewa)

-

Samoan

-

Íslenska

-

Bosanski

-

Kreyòl

Tags

gate.io margin trading

margin trading on gate.io

margin trading gate.io

gate.io leverage

gate.io margin lending

gate.io margin trading usa

cross margin trading explained

cross margin trading in gate.io

gate.io cross margin trading

crypto cross margin trading

cryptocurrency cross margin trading

cross margin account

cross margin leverage

cross margin explained

how to calculate cross margin

what is cross margin trading

cross margin futures

what is cross margin

what is margin on trading

how to trade full margin

how to use a margin trading

margin trading meaning

margin trading crypto

margin trading cryptocurrency

margin trading example

margin trading advantages

trading with a margin account

margin trading brokers

margin trading basics

margin trading bitcoin usa

margin trading bitcoin

margin trading crypto in the us

margin trading guide

margin trading in crypto

margin trading in the us

margin trading crypto usa

margin trading account

margin trading how it works

margin trading usa crypto

gate.io conduct margin trading

gate.io using margin trading